Evolution of

activities

Good results, with growth in the main figures of the income statement.

The 2024 financial year has taken place in a complex macroeconomic and geopolitical environment. In the geopolitical sphere, the conflict between Russia and Ukraine continues with no prospect of resolution in sight. In addition, the conflict between Israel and Palestine must be added, which aggravates global uncertainty, as well as the growth of economies for the coming months.

In terms of the macroeconomic scope, despite the aforementioned geopolitical situation, it is worth noting the notable moderation in inflation during the period compared to the previous year. This reduction in inflationary pressure has resulted in the start of an interest rate lowering strategy by the European Central Bank, with the last drop within the fiscal year, recorded on September 12th, 2024, closing the period with the reference rate at 3.65%.

Despite this, Logista has obtained good results and has achieved increases in the main headings of its income statement.

During the year, the integration and consolidation of the acquisitions made in the previous years continued, seeking to optimise the synergies identified and analysing new prospects for improvement. In addition, we have continued to seek new opportunities to acquire complementary and synergistic companies, having closed the acquisition of two transactions during the fiscal period.

- SGEL Libros: Logista Libros, a 50% subsidiary of Logista, completed the acquisition of SGEL Libros in October 2023. This acquisition has allowed us to consolidate Logista Libros as the leading independent book distributor in Spain. With the integration, important publishing funds have been incorporated, as well as the distribution of educational books into the activity of Logista Libros.

- Acquisition of Belgium Parcels Service (BPS), a company specialising in the urgent distribution of parcels, mainly temperature- controlled pharmaceutical products to hospitals and pharmacies in Belgium, Luxembourg, the Netherlands, France and Germany. This transaction complements the acquisition of Speedlink Worldwide Expres (Speedlink) in 2022, which marked Logista’s entry into the Dutch market, allowing access to the entire Benelux area, thus expanding its presence in the geographical area of Central Europe.

- In May 2024 we acquired the remaining 30% of Speedlink according to the agreements in force, thus becoming 100% owned by the Dutch company.

- In July, we completed the acquisition of the remaining 26.67% of Transportes El Mosca, according to the stipulated agreements. Thanks to this operation, Logista now has 100% ownership and consolidates its leadership as one of the largest Spanish logistics firms and becomes a benchmark in temperature-controlled full-load transport in southern Europe.

Economic sales

+4%

Adjusted EBIT

+5%

EBIT

+11%

Net profit

+13%

Iberia

Economic sales

+5%

Tobacco and related products

+13%

Transport

+7%

Pharmaceutical distribution

+10%

Other businesses

+4%

Adjustments in economic sales

+17%

Tobacco and related products

Revenues and Economic sales increased, primarily, due to the increase in tobacco prices, the increase in tariffs, in value-added services to tobacco manufacturers and the growth of the distribution of convenience products in Iberia.

Regarding the volumes of cigarettes distributed, RYO and others6, have increased slightly by 0.4% compared to 2023. This increase reflects the decrease in the volume of traditional cigarettes in Spain of (0.6)%, which has been offset by an increase in the volumes of traditional tobacco in Portugal and of RYO and others in both countries.

During the period, tobacco manufacturers increased the retail price of their products by between €0.20 and €0.25 per pack with no changes in excise duties on tobacco. This price increase has led to an estimated profit on inventories of €21 million during the year.

As for revenues from the distribution of convenience products, they have grown at single digit. Logista Retail has extended its activity to new channels (catering) and new products, by including frozen products in its commercial offer, thanks to the incorporation of new customers, while continuing to grow in its main channels (tobacconists and service stations) by reaching new points of sale and continuing to develop the most important product categories.

Transport

Economic sales in the long-haul transport segment have registered a single digit increase despite having been affected by lower demand in Europe, and by the Red Sea conflict that has led to a significant increase in transit time leading to delays in deliveries. Additionally, it is worth mentioning that the fruit and vegetable campaigns during the period in Spain have been lower due to the weather of the period.

Economic sales in the parcel segment have registered single-digit growth thanks to the growth in volumes distributed in both the pharmaceutical and food sectors.

Economic sales of the courier activity registered double-digit growth, thanks to the increase in shipments in Spain, Portugal and the Netherlands, as well as the consolidation of BPS within the segment.

Pharmaceutical Distribution

Revenues and economic sales grew thanks to the incorporation of new customers, and the increase in activity with current customers thanks to the contracting of new services, such as: the distribution of medicines to patients’ homes from the pharmaceutical service of hospitals and health centres, including the administration of medicines or the distribution of veterinary medicines, among others.

In addition, it should be noted that, in August 2024, Logista was once again awarded the management of logistics services for the strategic reserve of medicines and health products for the Government of Spain in the tender held by the Ministry of Health. The contract has a duration of two years with a possible extension of two additional years.

Other businesses

The publishing distribution business has registered an increase of 3.8% thanks to the incorporation of the national distribution contract of the RBA group’s publishing fund signed at the end of the previous year.

Adjusted operating profit posted a 1.7% growth including profit due to changes in inventories.

6 Volume of cigarettes, RYO y others includes units of heated tobacco

Italy

Economic sales

+9%

Tobacco and related products*

+9%

*It includes the new pharmaceutical distribution segment in Italy.

Adjusted EBIT

+14%

Tobacco and related products

Revenues and economic sales registered increases thanks to the positive impact of the profit on inventories, the increase in volumes and the variation in rates.

With regard to the volumes of cigarettes distributed, RYO and others 7 have registered a growth of 1.1% compared to the previous year, as a result of a reduction in volumes of traditional tobacco of (0.2)% which has been offset by the increase in volumes of new generation products.

During the fiscal year, the Government of Italy applied an increase to excise duties on traditional tobacco with effect from 1 January 2024. In response to this tax increase, the main tobacco manufacturers increased their prices on average between €0.10 and €0.30 per pack during the months of February to June, offsetting this tax increase. The profit on inventories as a result of the tax increase and tobacco prices has registered a net impact of c. €6 million vs.€-4 million in the previous year.

Economic Sales for the distribution of convenience products have registered a slowdown compared to the previous year in the sale of new generation products, particularly disposable electronic cigarettes, in the tobacconist channel.

Pharmaceutical Distribution

In the Logista Pharma Italia segment, during the year the necessary work was carried out to rebrand Gramma Farmaceutici to Logista Pharma Italia, adapting the systems and best practices to Logista Pharma standards. In addition, new laboratories have been added to its clientele, while existing customers have been integrated with the new systems implemented.

Adjusted EBIT increased by 14.0% including profit due to changes in inventories.

7 Volume of cigarettes, RYO y others includes units of heated tobacco

France

Economic sales

+4%

Tobacco and related products

+4%

Adjusted EBIT

+2%

Tobacco and related products

Revenues have increased compared to the previous year, thanks to the positive impact on the value of inventories and the higher rate that compensates for the reduction in volumes. However, economic sales decreased compared to the previous year due to the reduction in volumes

distributed, which has been partially offset by higher rates and the impact of the profit on inventories.

In terms of volumes distributed, the reduction in the volumes of tobacco distributed compared to the previous year was -(10.7)% in cigarettes, RYO 8 and others.8

With effect from March 1st, an increase in excise duties of €0.50/pack was implemented, which was later offset by an increase in sale price between €0.50 to €1.00/pack, published by the tobacco manufacturers. Tobacco tax and price movements had an estimated profit on inventory of €8 million in the period, vs. a positive impact of €7 million during previous year.

Adjusted EBIT grew by 2% including profit due to changes in inventories.

8 Volume of cigarettes, RYO y others includes units of heated tobacco

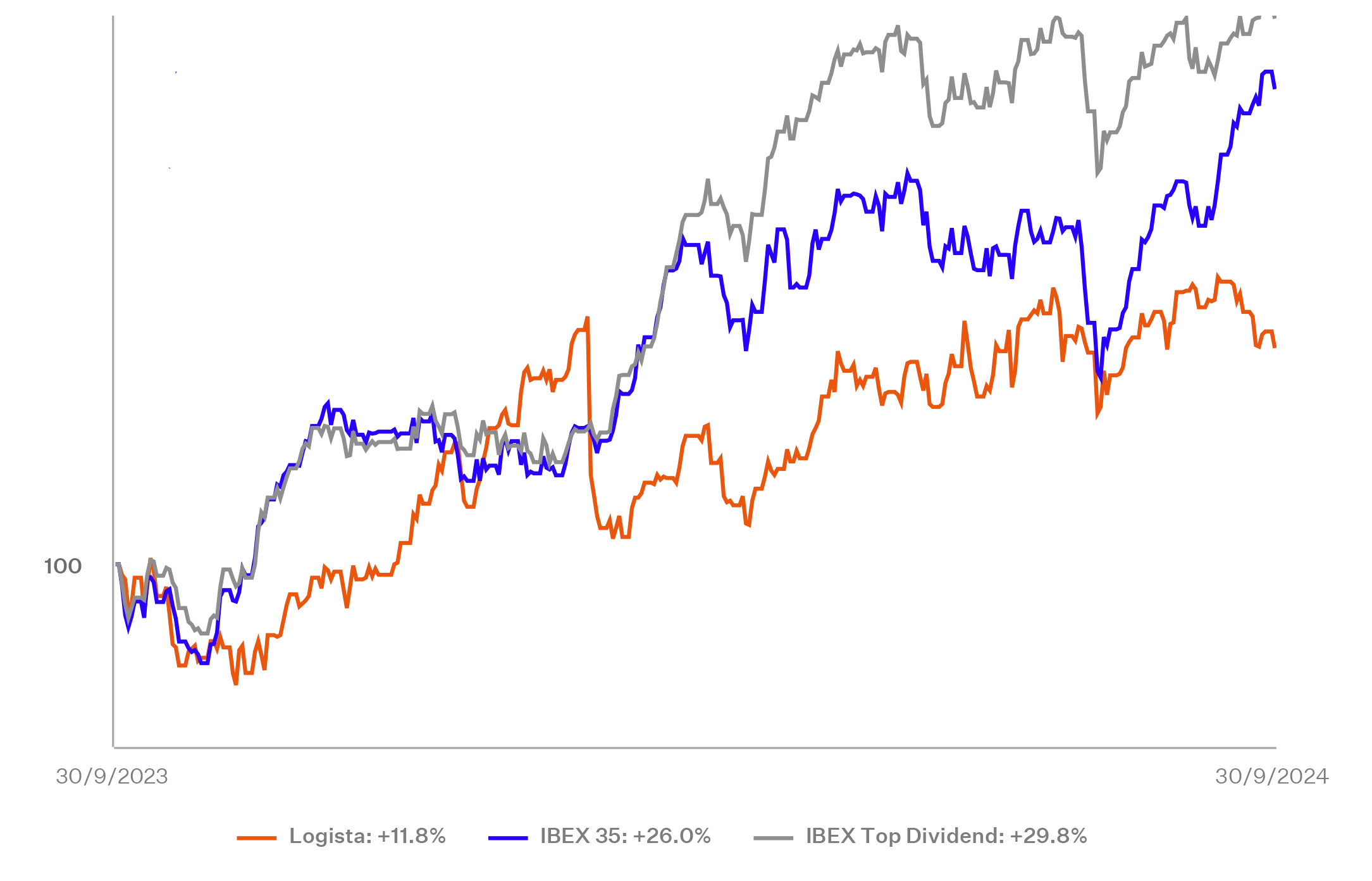

Logista in the stock exchange market

Share price evolution in 2024

Fiscal year

2023 closing price

24.20 €

2023 closing price

24.20 €

Fiscal year

2024 closing price

27.06 €

2024 closing price

27.06 €

Logista was relisted on the Spanish Stock Exchange in July 2014.

Since December 19, 2022, it is part of the IBEX 35, a Spanish selective that compares the 35 companies with the highest liquidity.

In addition, Logista is part of other stock market indices, such as: general index of the Madrid Stock Exchange, IBEX Top Dividend, FTSE4Good IBEX, IBEX Gender Equality and Bloomberg Gender Equality (GEI).

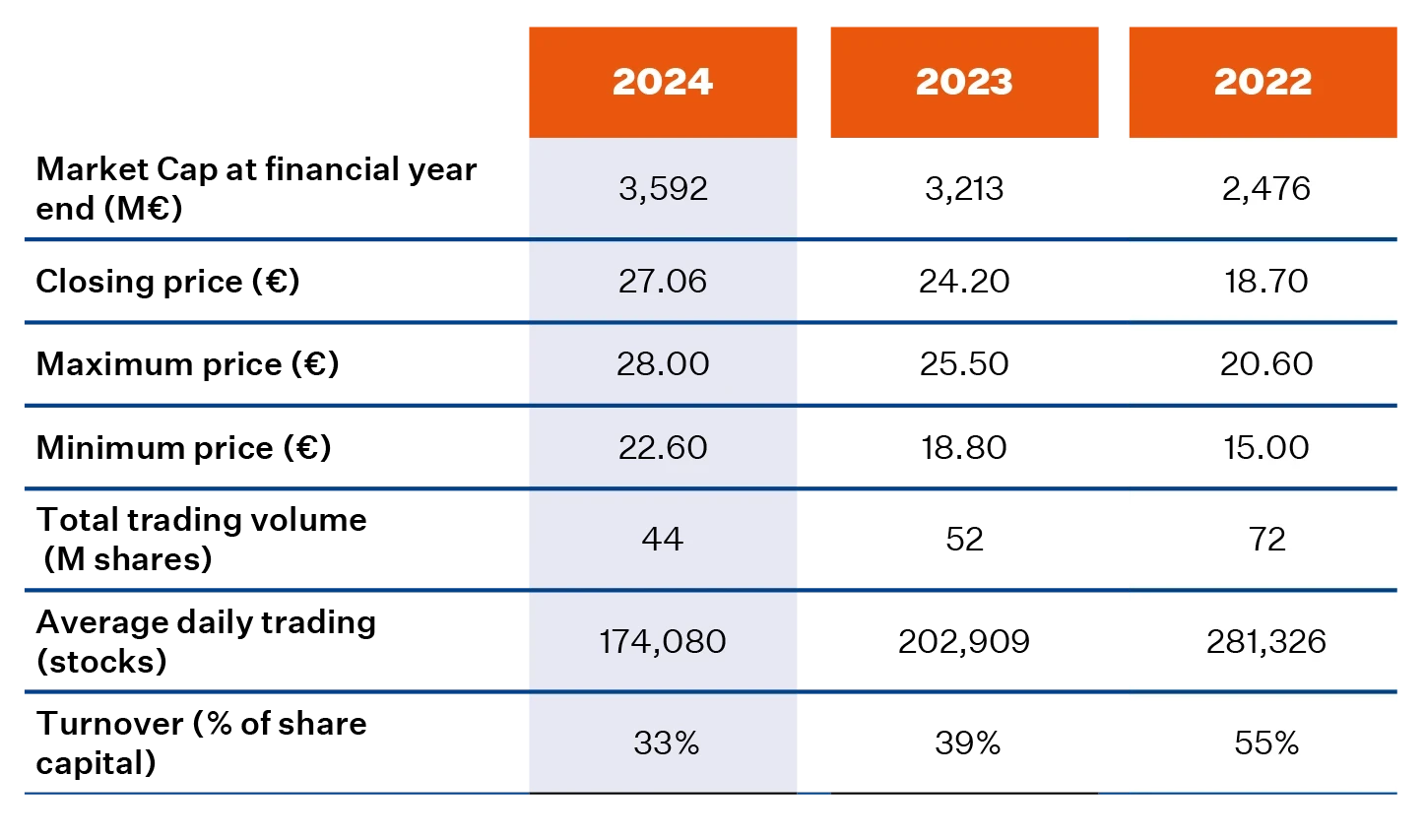

Market Capitalization as of September 30th, 2024

+12%

Analysts’ target price as of 2024 financial year

Dividends

Logista’s dividend policy, subject to approval by the general meeting of shareholders, consists of distributing a dividend (“payout”) of at least 90% of the annual consolidated net profit.

More than

dividends distributed since the IPO

Pay out

Analysts and investors

At the end of the 2024 financial year, 14 analysis firms covered Logista, one more firm than the previous financial year. Of these 14 firms, 13 maintain buy recommendations and one of them maintains a hold recommendation, with an average target price of 31.19 euros.

Market Contacts

More than

Contacts in the market

More than

Meetings

Roadshows

Conferences with investors

Historical data of the stock

Source: Bloomberg

Historical maximum share price

as of September 12th, 2024

Capital structure

Mainly to comply with the commitments to deliver shares resulting from the Company’s incentive plans, as well as with the liquidity contract signed on January 20, 2021, with Banco Santander S.A.

All Logista shares belong to a single class and series with identical rights.

Communications and other relevant information to the CNMV in 2024

In 2024 no inside information was communicated to the CNMV.

Significant shareholdings

Name

Imperial Brands PLC

Masaveu Herrero, Fernando

FMR LLC

% of total voting rights

50.01%

5.20%

5.20%

According to information sent to the CNMV by shareholders as of 30.09.24

Investor’s agenda

6 November 2024: results 2024

29 August 2024: Interim dividend payment (0.56€ per share)

24 July 2024: Q3-2024 results

8 May 2024: H1-2024 results

29 February 2024: Payment of complementary dividend (1.36€ per share)

5 February 2024: Q1-2024 results

2 February 2024: General shareholders’ meeting 2023 (1st call)