Appendices

Appendix I

About this report

This integrated annual report is drafted in accordance with the guidelines set out in the International Integrated Reporting Council (IIRC)’s framework for the preparation of integrated reports and in line with the GRI standards framework.

This report includes the updated non-financial information reporting statement and the annual CSR report and has been subject to an independent external review. The independent assurance report, which includes the objectives and scope of the external review, as well as the procedures used and their conclusions (appendix VI).

This document forms part of the FY2024 consolidated Management Report of Logista Integral, S.A. and its subsidiary companies. It is subject to the same criteria for approval, presentation and publication as the management report. By drafting this report, Logista complies with the provisions of Articles 262 of the Spanish Companies Act and Article 49 of the Spanish Code of Commerce, as amended by Act 11 of 28 December 2018 on non-financial information and diversity.

The management report was formulated by the board of directors on November 5, 2024. The report’s quantitative data correspond to the year 2024 financial year – the period from 1 October 2023 to 30 September 2024 Figures are rounded.

The quantitative data in the environmental impact minimisation chapter for the 2024 financial year include estimates due to the lack of actual data at the time of preparation of this report. The 2023 data reported in this report are different from those reported in the 2023 integrated annual report as they have been updated with actual data during 2024.

The GHG protocol categories included in the carbon footprint calculation are the following: scope 1: emissions from mobile combustion, emissions from combustion from stationary sources and fugitive emissions, scope 2: emissions from the consumption of electricity, considering the market-based criterion, scope 3: emissions from the consumption of goods, emissions from activities related to fuel and energy (not controlled by the company), emissions from transport and distribution of products, emissions from waste generated in operations and emissions from franchises.

The main databases used for the applied emission factors are DEFRA (Department for Environment Food & Rural Affairs) from United Kingdom, HBEFA (Handbook Emission Factors for Road Transport), UNE-EN 16258:2013 Methodology for calculation and declaration of energy consumption and GHG emissions of transport services (freight and passengers) and the European Environmental Agency.

The qualitative information included in the report explains the historical performance and the performance expected by the company from analysis of the current context. It does not make a commitment to attaining those objectives, since they are subject to risks and uncertainties.

The scope of this report encompasses all the operations carried out by 100% of Logista’ subsidiaries included in the consolidation scope, which means that the financial year 2024 sustainability indicators include data from Belgium Parcels Services (BPS), a company acquired in 2024 and which was not consolidated in the 2023 report.

In addition, according to the analysis completed and as required by Law 11 of 28 December 2018, Logista companies which have a legal obligation to present a non-financial reporting statement in accordance with Law 11 of 28 December 2018, and the new wording of Article 262.5 of the Spanish Code of Commerce, are exempt from issuing a non-financial reporting statement as this information is included in the 2024, integrated annual report, except for Logista Libros S.L. which will issue its own non-financial reporting statement given that it is equity-accounted by Logista.

This report complies with the requirements established by the European Directive 2014/95/EU of the European Parliament and of the Council, transposed into Spanish law through Law 11/2018, of December 28. It also includes information regarding climate change, as a result of the preliminary work we have done throughout this financial year to prepare for the regulatory requirements that will come into force in this matter in the next fiscal year. In addition, data is provided on the eligibility of the activities for the 6 climate-environmental objectives and the alignment for the objectives of mitigation and adaptation to climate change, in order to comply with the Taxonomy Regulation (EU) 2020/852.

This report has been prepared taking into account the regulations on corporate governance.

For further information on the 2024 financial year, Logista also publishes the following reports, which are also available on our website: annual accounts, annual report on corporate governance and annual report on remunerations of directors.

Appendix II

Materiality analysis

GRI 3-1

As a starting point in the project to define Logista’s ESG strategy over the next 3 years (2024-2026), we completed a materiality assessment with the aim of identifying, evaluating and prioritising the environmental, social and governance (ESG) issues that have the greatest impact on the company and its stakeholders in 2023, This has allowed us to define Logista’s ESG strategy and goals and tackle and respond to the needs and expectations of our various stakeholder groups.

We employed a double materiality approach to analyse both Logista’s ESG impact on its surroundings as far as the company’s stakeholders are concerned, and the financial impact that these material ESG topics have on Logista itself. In addition, while completing this process we added a new stage to our analysis to examine the scope and scale of the impact caused by these material topics and to assess what actions can be taken to remediate this impact in order to improve the company’s results.

In the current financial year, given that there have been no significant changes either in the macroeconomic, social, operational or regulatory context, or in Logista, we have decided to maintain the results of the double materiality analysis carried out in fiscal year 2023.

Below, we detail the different phases that we followed in carrying out the materiality analysis, from the identification and selection of material issues to obtaining the materiality matrix.

1. Identifying and selecting material topics

In order to identify and select the material topics, i.e. the ESG-related matters that have the greatest impact on Logista or its stakeholders, we included both internal and external sources in our analysis in order to take a range of different topics into account, such as ESG trends, the regulatory framework, our own internal context and that of our main competitors, and the requirements of the various stakeholder groups. This process was carried out in accordance with the main Global Reporting Initiatives (GRI).

As a result, we identified 24 material topics:

Area

Material topic

Corporate governance

1. Good governance and responsible leadership

2. Composition of the board of directors and board member remuneration

3. Legal framework and adjustment to regulatory changes

4. Systems for managing and controlling risk

5. Cybersecurity and data protection

6. Sustainable investment

Ethics

7. Ethics and anti-corruption

8. Communications and transparent reporting

9. Human rights

Responsible supply chain management

10. Responsible procurement and contracting practices

11. Circular economy and waste management

12. Safety and quality of products/services

13. Microeconomic and geopolitical climate

Climate change

14. GHG emissions

15. Energy consumption

16. Innovation and new sustainable technologies

Human capital

17. Employment practices

18. Training and development of human capital

19. Attracting and retaining talent

20. Diversity, equality and inclusion

21. Health, safety and well-being

Standing with society

22. Customer engagement

23. The importance of tobacco distribution as part of the Company’s business

24. Socioeconomic impact on the local community

As a result, we identified 24 material topics:

Area

Material topic

Corporate governance

1. Good governance and responsible leadership

2. Composition of the board of directors and board member remuneration

3. Legal framework and adjustment to regulatory changes

4. Systems for managing and controlling risk

5. Cybersecurity and data protection

6. Sustainable investment

Ethics

7. Ethics and anti-corruption

8. Communications and transparent reporting

9. Human rights

Responsible supply chain management

10. Responsible procurement and contracting practices

11. Circular economy and waste management

12. Safety and quality of products/services

13. Microeconomic and geopolitical climate

Climate change

14. GHG emissions

15. Energy consumption

16. Innovation and new sustainable technologies

Human capital

17. Employment practices

18. Training and development of human capital

19. Attracting and retaining talent

20. Diversity, equality and inclusion

21. Health, safety and well-being

Standing with society

22. Customer engagement

23. The importance of tobacco distribution as part of the Company’s business

24. Socioeconomic impact on the local community

2. Assessing and prioritising material topics

During this phase of the process we introduced new measures to improve the quality of our analysis, carrying out a broader assessment of the identified topics and prioritising from two different perspectives: based on the significance of their impact, and on their financial materiality. We also extended the analysis to add the scope and scale of such impacts and the actions that can be taken to remediate them.

During the previous financial year, a double materiality assessment was the primary tool for assessing and prioritising material topics, prioritising them based on their impact in terms of Logista’s ESG impact on its surroundings and their impact on the Company itself.

3. Significance

We sought the opinion of representatives from the different stakeholder groups in order to gain their view on the importance of each of the material topics identified.

When selecting these representatives we took account of Logista’s geographical presence, in order to obtain a global overview.

In total we contacted more than 3,000 people to assess the materiality of the impact analysed, as compared with the 900 contacted in our previous analysis. Representatives from all our stakeholder groups were contacted (investors, customers, suppliers, employees, ratings agencies, public institutions, industrial associations, social agents, etc.).

As regards financial materiality, which was analysed for the first time this year, we contacted 300 people from the organisation.

Our assessment was carried out by sending questionnaires to each of the representatives from the different stakeholder groups. These questionnaires included the material topics being analysed, along with a brief description in order to aid comprehension.

4. Impact

To improve our assessment process, we began to examine the scope and scale of the impact and what actions can be taken to remedy the material topics during 2023. We held several working sessions in order to present the analysis and explain this new phase, in which members of both the steering committee and the sustainability committee were required to complete a questionnaire on both the scope and remediability of the impacts.

5. Prioritisation

The results of this analysis are shown in a materiality matrix, in which the X axis displays the materiality of the impact, and the Y axis shows its financial materiality. The most significant material topics are those that appear in the upper right quadrant of the matrix: good governance and responsible leadership, legal framework and adaptation to regulatory changes, cybersecurity and data protection, responsible purchasing and contracting practices, macroeconomic and geopolitical context, innovation and new sustainable technologies, and relevance of tobacco distribution to business activity.

This symbol is used throughout the report to indicate the topics considered to be most significant

is used throughout the report to indicate the topics considered to be most significant

6. Assimilating results

This materiality assessment was fundamental to Logista’s ESG strategy definition project (2024-2026), with the most significant material topics identified forming part of this strategy and of the goals set out for the coming 3 years.

GRI 2-29

Stakeholders

Logista defines its stakeholders as those groups whose interests, needs or expectations have an impact on or are any way affected by the Company’s business operations, either directly or indirectly, and as such have the ability to influence our decisions.

During 2023, as part of Logista’s ESG strategy definition project for the coming 3 years (2024-2026), we reviewed our list of stakeholders and identified some new groups. The main stakeholder groups identified are customers, suppliers, shareholders and investors, employees, and society in general, including a range of groups such as ratings agencies, social agents, environmental groups, public institutions and business and industry associations, among others.

In the current year, and after reviewing these interest groups, they have been considered valid as no significant changes have occurred either in Logista or in its macroeconomic, social, operational or regulatory context.

As a company, we encourage ongoing, open and transparent dialogue with all our stakeholders. We therefore provide our stakeholder groups with various communication channels that are specifically tailored to meet the needs of each group, for example providing specific telephone numbers and email addresses and holding meetings among other options. We also offer cross-cutting communication channels that are available to all groups, such as the Company’s corporate website (www.logista.com) and the corporate reports that we publish every year.

Information is mostly shared or published via the following channels:

- Spanish Securities Markets Commission (CNMV)

- Corporate website

- Other means of communication, for example, via the email address used by analysts and investors (investor.relations@logista.com)

- Logista’s investor relations department and corporate communications management team

Stakeholders

Specific communication channels for each interest group

Clients

• Call centres, customer service and after-sales

• Satisfaction surveys

• Trade fairs

• Meetings

• Transactional websites and applications

Suppliers

• Meetings

• Audits

• Email communications, etc.

Shareholders and investors

• General shareholders meeting

• Investor relations e-mail and telephone

• Corporate website

• Social networks

• Participation in conferences, roadshows and face-to-face, telephone or online meetings

• Presentations of half-yearly and full-year results

Employees

• Internal communication through the intranet, social networks, notice boards, etc.

• Recreational, sports and solidarity activities

• Welcome meetings

• Meetings with employee representatives

Society in general

• Email and telephone

• Corporate website

• Meetings

• Collaboration with NGOs and associations

• Active participation in ESG ratings

• Interaction with public institutions

Stakeholders

Specific communication channels for each interest group

Clients

• Call centres, customer service and after-sales

• Satisfaction surveys

• Trade fairs

• Meetings

• Transactional websites and applications

Suppliers

• Meetings

• Audits

• Email communications, etc.

Shareholders and investors

• General shareholders meeting

• Investor relations e-mail and telephone

• Corporate website

• Social networks

• Participation in conferences, roadshows and face-to-face, telephone or online meetings

• Presentations of half-yearly and full-year results

Employees

• Internal communication through the intranet, social networks, notice boards, etc.

• Recreational, sports and solidarity activities

• Welcome meetings

• Meetings with employee representatives

Society in general

• Email and telephone

• Corporate website

• Meetings

• Collaboration with NGOs and associations

• Active participation in ESG ratings

• Interaction with public institutions

Appendix III

Composition of Logista

GRI 2-1, 2-6a, 2-6c

Company name: Logista Integral, S.A.

Tax ID: A-87008579

Registered office: calle Trigo 39. Polígono industrial Polvoranca. 28914, Leganés (Madrid)

Logista Integral, S.A.

Compañía de Distribución Integral Logista S.A.U. (100%)

Logista Freight S.A.U. (100%)

Logesta Deutschland Gmbh (100%)

Logista Freight France,SARL (50%)

Logista Freight Italia, Srl (100%)

Logesta Lusa, Lda. (51%)

Logista Freight Polska, sp. z o.o. (51%)

Logista Freight Polska, sp. z o.o. (49%)

Herinvemol S.L. (100%)

Transportes El Mosca S.A.U (100%)

– Mosca Portugal LDA (50%)

Mosca Marítimo S.L.U. (100%)

– Mosca Portugal LDA (50%)

– Mosca China (100%)

Mosca Marítimo Baleares S.L. (100%)

Innoreste, S.L.U. (100%)

– Albacetrans, S.L.U. (100%)

Ordimur, S.L.U. (100%)

Transportes El Mosca Murcia, S.A.U. (100%)

Mosca Italia, Srl (100%)

Logista Strator , SLU (100%)

Logista Pharma, S.A.U. (100%)

Be to Be Pharma, S.L.U (100%)

Logista Pharma Canarias, S.A.U (100%)

Dronas 2002, S.L.U. (100%)

Carbó Collbatallé, S.L.U. (100%)

Logista Retail, S.A.U. (100%)

Logista Libros, S.L. (50%)

SGEL Libros, S.L.U. (100%)

La Mancha 2000, S.A.U. (100%)

Logista Payments, S.L.U. (100%)

Compañía de Distribución Integral de Publicaciones Logista, S.L.U. (100%)

Logista Regional de Publicaciones, S.A.U. (100%)

Distribución Publicaciones Siglo XXI Guadalajara, S.L. (80%)

Distribuidora de Aragón, S.L. (5%)

Distribuidora de Publicaciones del Sur, S.L. (50%)

Distribuidora Valenciana de Ediciones, S.A. (100%)

Publicaciones y Libros, S.A.U. (100%)

Sociedad Anónima Distribuidora de Ediciones (70%)

Logista France Holding S.A. (100%)

Logista Promotion et Transport SAS (100%)

– Logista Freight France, SARL (50%)

Logista France SAS (100%)

Logista Retail France SAS (100%)

Logista Italia, S.p.A. (100%)

Logista Retail Italia, S.p.A. (100%)

Logista Pharma Italia, Srl (100%)

CDIL- Companhia de Distribuiçao Integral Logista Portugal, S.A. (100%)

Midsid Sociedad Portuguesa de Distribuiçâo, S.A. (100%)

Logista Transportes Transitários e Pharma, Unipessoal, Lda. (100%)

– Logesta Lusa, Lda. (49%)

Compañía de Distribución Integral Logista Polska, sp. z o.o (100%)

Logista Transport Europe B.V. (100%)

Speedlink Worldwide Express BV (100%)

24 Hours BV (100%)

German-Ex BV (100%)

3 for one SA (100%)

Belgium Parcels Services SRL (100%)

Appendix IV

Taxonomy

Taxonomy Regulation (EU) 2020/8521, as a key component of the European Commission’s Green Deal action plan (“EU Green Deal”), seeks to redirect capital flows in order to achieve a more sustainable economic framework aligned with the Sustainable Development Goals, as well as, in particular, in order to achieve a carbon-neutral economy by 2050.

The Taxonomy Regulation proposes the creation of an EU-wide classification system for environmentally sustainable economic activities. It thus provides a common language that companies, investors and other stakeholders can use to identify economic projects and activities with a positive and substantial impact on the climate and the environment. In addition, the taxonomy introduces disclosure obligations for companies and financial market participants in order to standardise sustainability reporting methodologies.

In line with said Regulation, we have reviewed the list of eligible economic activities described in the DelegatedRegulation(EU)2021/21392 and Commission Delegated Regulation (EU) 2022/12143 corresponding to the first two environmental objectives established: (1) mitigation of climate change and (2) adaptation to climate change.

Additionally, and taking into account the new modifications to the regulatory framework of the taxonomy that occurred during 2023, we have considered the modified selection criteria, as well as the new activities that are part of Delegated Regulation(EU)2023/24854 of June 27, related to the objectives of mitigation and adaptation to climate change.

We have also consulted the list of new activities of Delegated Regulation (EU) 2023/24865 published on June 27, which includes those economic activities that contribute substantially to the rest of the environmental objectives: (3) sustainable use and protection of water and marine resources, (4) transition to a circular economy, (5) prevention and control of pollution, pollution, and (6) protection and recovery of biodiversity and ecosystems.

In accordance with the above-mentioned annexes, we have identified those Company activities that are considered eligible or aligned. In this regard, we have taken into account the following:

Eligible economic activities under the taxonomy are those that meet the definition referred to in the “Activity description” section of the Annexes to the delegated acts that list activities that can substantially contribute to one or more environmental objectives, regardless of whether that economic activity meets any or all of the technical screening criteria set out in those delegated acts. Likewise, an ineligible economic activity under the taxonomy is any economic activity that is not listed in those delegated acts.

Economic activities aligned with the taxonomy are those eligible activities that also meet the technical selection criteria set out in the aforementioned Annexes (i.e. they contribute substantially to an environmental objective and do not significantly harm any of the other environmental objectives) and that respect the minimum safeguards required, in accordance with Article 3 of the Taxonomy Regulation6.

For the set of economic activities of the Company determined as eligible, both aligned and non- aligned, we have obtained the key performance indicators (KPIs), at a consolidated level. These are those associated with: Turnover (revenue), capital expenditures (CapEx) and operating expenses (OpEx), in accordance with the provisions of Delegated Regulation (EU) 2021/2178 of July 67. Additionally, the KPI disclosure tables have been prepared in accordance with the provisions of Delegated Regulation(EU)2023/24868 of June 27, which modifies Delegated Regulation (EU) 2021/2178.

While for the 2023 financial year activity report we disclosed the KPIs in relation to the eligibility and alignment of its taxonomic activities as stipulated by Delegated Regulation 2021/2139 and Delegated Regulation 2022/1214, in the 2024 financial year report we must, additionally, carry out the eligibility analysis regarding the new activities included in Delegated Regulation 2023/2485 and Delegated Regulation 2023/2486. Once all eligible activities have been identified, we have calculated and disclosed the associated KPIs (eligibility KPIs), in accordance with the reporting indications stipulated in the regulations.

Identification of elegible activities

In order to disclose the calculation of the key eligibility indicators, we have thoroughly assessed the potential eligibility of all the economic activities carried out by the group. In this analysis, we have taken into account both the activities that generate income for Logista and those of a transversal nature, which, without generating income, represent a capital and/or operating expense (CapEx and/or OpEx) for the Company.

In this way, and to confirm the eligibility of each of the initially identified activities, these were cross- referenced with the definitions present in Delegated Regulations 2021/2139, 2022/1214 and 2023/2485. This analysis resulted in the following table, which lists the activities carried out by Logista and their correspondence with activities categorized as eligible according to said delegated acts, for the objective of climate change mitigation:

1 Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 establishing a framework to facilitate sustainable investments and amending Regulation (EU) 2019/2088.

2 Commission Delegated Regulation (EU) 2021/2139 of 4 June 2021 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council and establishing technical screening criteria for determining the conditions under which an economic activity is considered to make a substantial contribution to climate change mitigation of or adaptation to it, and for determining whether that economic activity does not cause significant harm to any of the other environmental objectives.

3 Commission Delegated Regulation (EU) 2022/1214 of 9 March 2022 amending Delegated Regulation (EU) 2021/2139 as regards economic activities in certain energy sectors and Delegated Regulation (EU) 2021/2178 as regards the public disclosure of specific information on those economic activities.

4 Commission Delegated Regulation (EU) 2023/2485 of 27 June 2023 amending Delegated Regulation (EU) 2021/2139 establishing additional technical screening criteria for considering an economic activity as making a substantial contribution to climate change mitigation or adaptation, and for determining whether that economic activity does not cause significant harm to any of the other environmental objectives.

5 Commission Delegated Regulation (EU) 2023/2486 of 27 June 2023 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by establishing technical screening criteria for determining the conditions under which an economic activity is deemed to contribute substantially to the sustainable use and protection of water and marine resources, to the transition to a circular economy, to pollution prevention and control, or to the protection and recovery of biodiversity and ecosystems, and for determining whether that economic activity does not cause significant harm to any of the other environmental objectives, and amending Commission Delegated Regulation (EU) 2021/2178 as regards the disclosure of targeted public information on those economic activities.

6 Article 3 of the Taxonomy Regulation refers to the conformity of alignment based on: (1st) Compliance with the technical selection criteria (in accordance with the corresponding activity in terms of: a) substantial contribution to one or more environmental objectives and b) not significantly harming any of the remaining objectives ), and (2nd) compliance with the defined minimum safeguards .

7 Commission Delegated Regulation (EU) 2021/2178 of 6 July 2021 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by specifying the content and presentation of information to be disclosed by undertakings subject to Articles 19a or 29a of Directive 2013/34/EU concerning environmentally sustainable economic activities and specifying the methodology for complying with the disclosure obligation.

8 Commission Delegated Regulation (EU) 2023/2486 of 27 June 2023 supplementing Regulation (EU) 2020/852 of the European Parliament and of the Council by establishing technical screening criteria for determining the conditions under which an economic activity is deemed to contribute substantially to the sustainable use and protection of water and marine resources, to the transition to a circular economy, to pollution prevention and control, or to the protection and recovery of biodiversity and ecosystems, and for determining whether that economic activity does not cause significant harm to any of the other environmental objectives, and amending Commission Delegated Regulation (EU) 2021/2178 as regards the disclosure of targeted public information on those economic activities.

Description of the activity

Reference to taxonomy activity

Collection of used boxes for subsequent recycling by Logista Italia.

Purchase of electric bicycles.

Additions of assets (personal transportation vehicles) resulting from the acquisition of BPS. Investment in vehicles.

Additions of assets associated with rents under IFRS 16.

Transportation services under operational control of Logista.

Investment in semi-trailers (Logista Freight, Carbó and Dronas ) and vehicles (El Mosca).

Additions to rental assets under IFRS 16.

Additions of assets (cargo vehicles) resulting from the acquisition of BPS.

Installation of air conditioning and lighting equipment. Renovation of skylights, roofs and enclosures.

Installation of electric vehicle charging points next to buildings.

Installation of climate control systems for group assets.

Installation of photovoltaic panels on group assets.

Investments related to data processing infrastructure, including deployment of new servers.

CCM 5.5. Collection and transport of non-hazardous waste in source segregated fractions

CCM 6.4. Operation of personal mobility devices, cycle logistics

CCM 6.5. Transport by motorcycles, passenger cars and light commercial vehicles

CCM 6.6. Freight transport services by road

CCM 7.3. Installation, maintenance and repair of energy efficiency equipment

CCM 7.4. Installation, maintenance and repair of charging stations for electric vehicles in buildings (and parking spaces attached to buildings)

CCM 7.5. Installation, maintenance and repair of instruments and devices for measuring, regulation and controlling energy performance of buildings

CCM 7.6. Installation, maintenance and repair of renewable energy technologies

CCM 8.1. Data processing, hosting and related activities

Description of the activity

Collection of used boxes for subsequent recycling by Logista Italia.

Purchase of electric bicycles

Additions of assets (personal transportation vehicles) resulting from the acquisition of BPS.

Investment in vehicles.

Additions of assets associated with rents under IFRS 16.

Transportation services under operational control of Logista.

Investment in semi-trailers (Logista Freight, Carbó and Dronas ) and vehicles (El Mosca).

Additions to rental assets under IFRS 16.

Additions of assets (cargo vehicles) resulting from the acquisition of BPS.

Installation of air conditioning and lighting equipment. Renovation of skylights, roofs and enclosures.

Installation of electric vehicle charging points next to buildings.

Installation of climate control systems for group assets.

Installation of photovoltaic panels on group assets.

Investments related to data processing infrastructure, including deployment of new servers.

Reference to taxonomy activity

CCM 5.5. Collection and transport of non-hazardous waste in source segregated fractions

CCM 6.4. Operation of personal mobility devices, cycle logistics

CCM 6.5. Transport by motorcycles, passenger cars and light commercial vehicles

CCM 6.6. Freight transport services by road

CCM 7.3. Installation, maintenance and repair of energy efficiency equipment

CCM 7.4. Installation, maintenance and repair of charging stations for electric vehicles in buildings (and parking spaces attached to buildings)

CCM 7.5. Installation, maintenance and repair of instruments and devices for measuring, regulation and controlling energy performance of buildings

CCM 7.6. Installation, maintenance and repair of renewable energy technologies

CCM 8.1. Data processing, hosting and related activities

In particular, in relation to CCM activity 6.5. “Transport by motorcycles, passenger cars and light commercial vehicles”, most of the employee vehicles are counted as operating expenses. Therefore, since the OpEx that the Taxonomy defines has been considered as immaterial, these types of expenses do not count in the KPIs.

In particular, in relation to CCM activity 6.6. “Freight transport services by road”, transport services over which Logista exercises operational control have been identified as income-generating taxonomic activities. To determine which services can be classified as such, a proprietary methodology has been developed that takes into account the characteristics of the vehicles and their routes, defining whether or not there is control over the exact route of the service and control over the vehicle and the carrier. Additionally, following the provisions of the “activity description”, only the fleet of EURO VI stage E or later vehicles will be determined as eligible.

Furthermore, in relation to activity CCM 8.1. “Data processing, hosting and related activities”, we have identified as chargeable the items related to the management of software and hardware of the IT infrastructure, the technological platforms and the servers of the group.

In addition, with regard to the objective of adaptation to climate change, no activities have been identified that could contribute substantially to this objective. Consequently, it is considered that there are no eligible activities with respect to this objective.

As an additional process for this fiscal year, we secondarily analysed the activities listed in Delegated Regulation 2023/2486, considering the following activities as eligible for the objectives of transition to a circular economy and pollution prevention and control:

Description of the activity

Reference to taxonomy activity

Collection of used boxes for subsequent recycling by Logista Italia.

Collection of faulty point of sale (POS) terminals. Recycling vapers.

Installation of a condensate separator.

Sale of used point of sale (POS) terminals.

Acquisition and rental of point of sale (POS) terminals.

CE 2.3. Collection and transport of hazardous and non-hazardous waste

CE 2.3. Collection and transportation of hazardous and non-hazardous wastes

PPC 2.1. Waste collection and transportation

CE 2.4. Treatment of hazardous waste PPC

2.2. Treatment of hazardous waste

CE 5.4. Sale of second-hand goods

CE 5.5. Product as a service and other circular models of services oriented towards use and results

Description of the activity

Collection of used boxes for subsequent recycling by Logista Italia.

Collection of faulty point of sale (POS) terminals. Recycling vapers.

Installation of a condensate separator.

Sale of used point of sale (POS) terminals.

Acquisition and rental of point of sale (POS) terminals.

Reference to taxonomy activity

CE 2.3. Collection and transport of hazardous and non-hazardous waste

CE 2.3. Collection and transportation of hazardous and non-hazardous wastes

PPC 2.1. Waste collection and transportation

CE 2.4. Treatment of hazardous waste PPC

2.2. Treatment of hazardous waste

CE 5.4. Sale of second-hand goods

CE 5.5. Product as a service and other circular models of services oriented towards use and results

In particular, it has to be noted that the activity CE 5.5. “Product as a service and other circular service models oriented to use and results” is related to the acquisition and rental of POS (point of sale terminals) through a service model, as part of the solutions provided by Logista Strator. Additionally, the withdrawal of these devices due to breakdown would be eligible under activities CE 2.3. “Collection and transport of hazardous and non-hazardous waste” and PPC 2.1. “Collection and transport of hazardous waste”, while the sale of these devices after their rental stage constitutes another eligible activity, under activity CE 5.4. “Sale of second-hand goods”.

Alignment analysis

Once the above eligibility analysis was carried out, we have consequently proceeded to carefully determine: (I) compliance with the technical selection criteria relating only to the climate change mitigation objective (in terms of substantial contribution to said objective and in terms of not significantly harming any of the remaining environmental objectives), since no activity associated with the climate change adaptation objective has been identified and the regulation does not require in this first exercise to carry out said evaluation for the rest of the new objectives disclosed; and (II) compliance with the minimum safeguards.

Technical selection criteria

The following analysis is carried out in accordance with the provisions of Annex I of Commission Delegated Regulation (EU) 2021/2139 of 4 June 2021, which develops the technical selection criteria, which serve as a guide to conclude that an economic activity contributes substantially to, in this case, the mitigation of climate change, and to determine whether that economic activity does not cause significant harm to any of the other environmental objectives:

a. Criteria for substantial contribution to climate change mitigation

To determine the substantial contribution, the technical characteristics of each eligible activity with respect to the climate change objective have been analysed, as listed in the previous section “2. Identification of eligible activities”, in order to conclude whether or not they comply with the criteria for a substantial contribution to said objective. Throughout this evaluation, we have been gathering the necessary information to demonstrate compliance with this technical criterion.

The summary of this assessment, activity by activity of the taxonomy, is as follows:

CCM 5.5. Collection and transport of non-hazardous waste in source segregated fractions

In relation to this activity, it has been ensured that waste managers who collect used boxes reuse or recycle these boxes. This ensures compliance with the substantial contribution criterion applicable to this activity.

CCM 6.4. Operation of personal mobility devices, cycle logistics

The purchase of electric vehicles meets the applicable substantial contribution criterion.

CCM 6.5. Transport by motorcycles, passenger cars and light commercial vehicles

Logista has light electric vehicles and light plug-in hybrid electric vehicles in its fleet, therefore, these vehicles has zero direct emissions, and meet the substantial contribution criterion.

CCM 6.6. Freight transport services by road

Logista has electric freight vehicles in its fleet, and therefore these vehicles have zero direct emissions and meet the substantial contribution criteria.

CCM 7.3. Installation, maintenance and repair of energy efficiency equipment

In relation to the installation of heating and cooling equipment, it has been evaluated whether they meet the substantial contribution criterion, studying whether “they are classified in the two highest energy efficiency classes” corresponding to the type of equipment used “in accordance with the Regulation (EU) 2017/1369 and (its) delegated acts.”

In relation to the installation of lighting systems, LED systems are considered to be “energy efficient”, and therefore, are of substantial contribution.

CCM 7.4. Installation, maintenance and repair of charging stations for electric vehicles in buildings (and parking spaces attached to buildings)

The activity is the installation of electric vehicle charging points, so it meets the applicable substantial contribution criterion.

CCM 7.6. Installation, maintenance and repair of renewable energy technologies

The activity is the installation of photovoltaic panels on Logista assets, and therefore meets the applicable substantial contribution criterion.

CCM 8.1. Data processing, hosting and related activities

As regards this activity, the criteria for substantial contribution applicable to this activity, which is highly technically complex, have not been demonstrated. Although energy certifications are available for some of the facilities with data servers (ISO 50001), there is no certification as defined in the substantial contribution criteria (the European code of conduct on energy efficiency in data centres or the CLC TR50600-99-1 document from CENCEnelec). “Data centre facilities and infrastructures – Part 99-1: Recommended practices for energy management”).

b. Do no significantly harm any of the environmental objectives (DNSH – “Do No Significant “Harm ”)

The second set of technical criteria requires that, for each of the potentially aligned activities (i.e., the company’s eligible activities that meet point 1 of substantial contribution), it is assessed and evidenced that they do not significantly harm any of the other 5 environmental objectives.

Compliance with the DNSH criteria for climate change adaptation has been carried out at the corporate level, while compliance with the other DNSH criteria has been carried out for those activities for which a substantial contribution has been demonstrated, at least partially. These are the activities under the climate change mitigation objective: CCM 5.5., CCM 6.5., CCM 6.6., CCM 7.4. and CCM 7.6.

Compliance with DNSH criteria for climate change adaptation:

In order to comply with this DNSH criterion, Logista has carried out corporate-type work in which, firstly, all the climatic hazards indicated in the table in Appendix A of Annex I of Delegated Regulation 2021/2139 have been evaluated through a “screening”, determining those risks that were relevant to the type of activities carried out by Logista. Next, the degree of incidence of all physical risks considered material for the Company has been assessed. For this purpose, the IPCC scenarios: RCP 4.5 and RCP 8.5 have been used, evaluating the incidence of future climatic hazards in the short term (up to 20 years), medium term (21 to 40 years) and long term (41 to 100 years).

Once this step was completed, the economic- financial impact of climate risks was studied and assessed, categorising them based on the magnitude of the impact. In response to the risks with the most significant economic-financial impacts, Logista has begun to propose a series of mitigating measures to ensure that the residual risk is kept to a minimum.

Compliance with the remaining DNSH criteria (sustainable use and protection of water and marine resources; transition towards a circular economy; prevention and control of pollution, protection and recovery of biodiversity and ecosystems):

These DNSH criteria have been assessed by activity in the taxonomy. Specifically, with regard to the objectives of: “sustainable use and protection of water and marine resources” and “protection and recovery of biodiversity and ecosystems”, as indicated in Delegated Regulation 2021/2139, it is not appropriate to assess this DNSH criterion in any of the activities in the taxonomy indicated, given the characteristics of this type of economic activity. Consequently, the DNSH criteria in terms of the transition towards a circular economy and pollution prevention and control have been studied, reaching the conclusion that the activities assessed, which meet the criteria of substantial contribution that apply to them, also meet the applicable DNSH criteria.

In particular, with regard to CCM activity 5.5. “Collection and transport of non-hazardous waste in source segregated fractions”, it has been ensured that the waste collected in this activity is not mixed with other waste or materials with different properties.

Regarding activities CCM 6.5. “Transport by motorcycles, passenger cars and light commercial vehicles” and CCM 6.6. “Freight transport services by road”, in order to assess compliance with the DNSH criteria, it has been verified that the vehicles are approved for marketing in the European Union. In addition, it is assessed whether the tyres used comply with the requirements for external rolling noise and the coefficient of rolling resistance established in the corresponding technical criterion.

Regarding activity CCM 7.3. “Installation, maintenance and repair of energy efficiency equipment”, the compliance of the installed equipment with the RoHS directive and the REACH regulation has been assessed.

Regarding activities CCM 7.4. “Installation, maintenance and repair of electric vehicle charging stations in buildings (and in parking spaces attached to buildings)” and CCM 7.6. “Installation, maintenance and repair of renewable energy technologies”, none of the DNSH criteria need to be assessed except for the climate change adaptation criteria, so these activities comply with the technical application criteria.

Minimum Safeguards

This requirement involves demonstrating that the economic activity under evaluation is carried out in compliance with minimum social safeguards. To this end, it has been ensured that all procedures implemented by the company guarantee that our activities are carried out in accordance with the OECD Guidelines for Multinational Enterprises and the United Nations Guiding Principles on Business and Human Rights, including the principles and rights set out in the eight core conventions referred to in the International Labour Organization Declaration on Fundamental Principles and Rights at Work, and the International Bill of Human Rights (as indicated in Article 18 of Regulation 2020/852).

To assess compliance with the minimum safeguards, we have conducted an analysis of the policies and procedures implemented at Logista, analysing the four dimensions into which the requirement is divided: (1) human rights, including labour rights; (2) corruption and bribery; (3) taxation and (4) fair competition.

In relation to human rights, including the labour rights of workers, Logista has a code of conduct, a human rights policy, a supply chain due diligence policy on human rights and the environment, which demonstrate the Company’s commitment to human rights and establish the criteria and procedures to be followed to ensure respect for them, and has also established the general principles of supplier behaviour, in order to implement respect for Human Rights in all of the group’s suppliers.

In addition, we have a reporting channel operating through a secure platform that can be accessed from the corporate website, or also by email and post, through which all employees, managers, or authorized third parties (suppliers, clients, subcontractors, former employees, etc.) can confidentially and anonymously report any possible irregularity, non-compliance or behavior contrary to Logista’s ethical principles and values. This channel also has its own policy that has been designed to harmonize it with the standard on the reporting channel management system: UNE-ISO 37002:2021, as well as the requirements of Law 2/2023, of February 20, regulating the protection of people who report regulatory violations and the fight against corruption. In addition, in accordance with Logista’s training plan, employees receive training on respect for human rights.

On the other hand, Logista carries out an analysis and evaluates the human rights risks in its own operations. We have incorporated a tool that allows us to evaluate these risks in suppliers and third parties as an initial phase of the due diligence process, which is being developed during this fiscal year. This tool allows us to carry out a screening of the potential impact of risks on human rights. In this way, it facilitates the development of action and monitoring plans, potentially being useful for the development of impact management plans in the next fiscal years.

In terms of the fight against corruption and bribery, we have an anti-corruption policy, which establishes a series of general rules of conduct to prevent it, including guidelines in relations with business partners. At the level of internal control, the board of directors determines the risk control and management policy, from which we articulate a robust and proven internal control system, aimed at preventing criminal conduct, including the crimes of corruption, bribery and money laundering. Additionally, the compliance committee carries out the tasks of supervising and controlling the operation of the compliance system developed by Logista. Regarding the awareness- raising work carried out, Logista regularly trains its professionals in the prevention of money laundering and terrorist financing.

In terms of taxes, we have developed a high level of control in this area and we have the certification of the tax compliance management system, UNE 19602:2019. We recently updated Logista’s tax policies to incorporate aspects derived from regulatory changes. In addition, we regularly submit a Transparency Report to the Spanish Tax Agency.

Finally, in terms of fair competition, the group has developed a compliance programme in relation to the defence of competition, in accordance with the guidelines established in the Guide on compliance programmes in relation to competition rules of the National Commission of Markets and Competition (CNMC), dated June 10, 2020, and Standard UNE 19603:2023, on compliance management systems in the area of free competition of the Spanish Association for Standardization, dated November 22, 2023. As a main element of this programme, Logista has approved a competition policy. In addition, training programmes have been carried out for employees, including specific sessions for managers and the Management Committee. Additionally, a matrix of specific risks in terms of competition has been developed, and controls have been designed regarding these risks.

Furthermore, Logista has verified that there is no ongoing litigation against Logista that could constitute a violation of any of the areas indicated in the framework of minimum safeguards (human rights, corruption and bribery, taxation and fair competition).

Results of key indicators (eligibility and alignment KPIs)

Below is the process followed to calculate the key indicators (KPI) of eligibility and alignment, with respect to the activities evaluated according to the EU Taxonomy, as indicated in Annex I of Delegated Regulation 2021/2178 of July 6, 2021, which specifies the calculation criteria to be applied to obtain the three key indicators (KPIs): turnover, investment in fixed assets (CapEx) and operating expenses (OpEx).

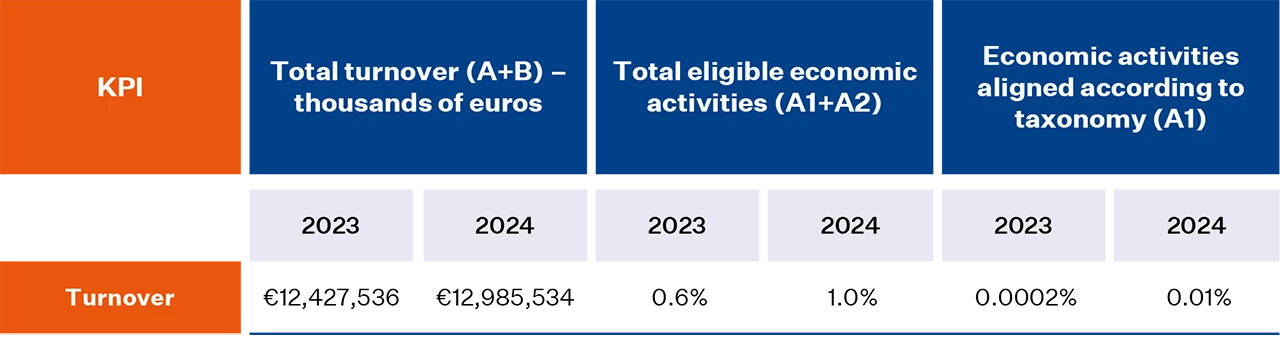

Turnover KPI

Delegated Regulation 2021/2178 defines the key indicator related to turnover as the quotient between the revenues associated with eligible activities and aligned activities (numerators) and the total revenues at group level (denominator). Such revenues correspond to those recognised in accordance with International Accounting Standard (IAS) 1, paragraph 82, letter a), adopted by Commission Regulation (EC) No 1126/2008.

The eligible and aligned revenues are partly linked to transport services over which Logista exercises operational control (related to activity 6.6. “Freight transport services by road”). In this regard, we have only identified eligible revenues for this activity in the following Logista companies: Logista Freight, Transportes El Mosca and Carbó Collbatallé9. To determine the eligible revenues, we have performed the calculations described below.

In the case of Logista Freight, the revenue figure corresponding to each of the routes carried out by this company has been collected. Given that each route may have required the use of one or more vehicles, and that each route may have been carried out with eligible and/or ineligible vehicles, an eligibility percentage has been obtained for each of the routes, which represents the proportion of eligible vehicles used on the route. This eligibility percentage allows obtaining the eligible revenue for each route, and the sum of all these revenues gives rise to the eligible revenue for Logista Freight.

In the case of Transportes El Mosca, the ratio of euros per average kilometre travelled by the fleet that carries out land transport of goods was first obtained. This ratio was multiplied by the kilometres travelled by eligible vehicles. It is considered that this calculation provides a reasonable estimate of the eligible income.

In the case of Carbó Collbatallé, the proportion between the kilometres travelled by the eligible vehicles and the kilometres travelled by the total number of vehicles in the fleet has been obtained, and this result has been multiplied by the turnover of Carbó Collbatallé corresponding to its handling, storage and transport activities. In the case of this company, the tasks of handling and storing cargo are intrinsic to the type of transport carried out (parcel segment), so the set of these revenues is considered to be linked to the CCM 6.6. activity of the taxonomy.

In addition, Strator’s business line has also been taken into account: income from the rental of POS terminals (activity CE 5.5. “Product as a service and other circular service models oriented towards use and results”) and income from the sale of used POS terminals (activity CE 5.4. “Sale of second- hand goods”).

Moreover, income associated with the handling and transport of waste was considered to the following Taxonomy activities: CCM 5.5. Collection and transport of non-hazardous waste in source segregated fractions” and CE 2.3. “Collection and transport of non-hazardous and hazardous waste”.

Furthermore, the denominator of this KPI appears in the consolidated annual accounts for the year ended 30 September 2024 of Logista (see “Revenue” figure in the consolidated income statement).

9 Revenue from vehicles under operational control of Belgium Parcels Service (BPS), Gramma Farmaceutici and Speedlink correspond to vehicles that are not eligible (pre-EURO VI, Stage E), so they do not contribute to the KPIs.

Regarding the year-on-year evolution of the data, there is an increase in the alignment percentages, as a result of recognizing revenues from the “Green Boxes” system. In addition, there is an increase in the eligibility percentages, which is a consequence of the greater importance of logistic activities in the Group’s income after the acquisition of Transportes El Mosca and Carbó Collbatallé. The increase in the eligibility percentage is also influenced by the entry of a new income-generating activity: CE 5.5. “Product as a service and other circular service models oriented towards use and results”.

Additional information:

Given the particularities of Logista’s business, most of our revenues are derived from the sale and purchase of the products we supply, as a wholesaler, to tobacconists and other convenience stores. Consequently, in order to provide additional information that will help the reader to evaluate Logista’s performance compared to companies that are exclusively dedicated to transport and logistics without intermediating in the purchase and sale of products, we propose to use the gross profit as figure of reference, due to the gross profit excludes from ordinary revenues the procurement item, which is the result of Logista’s activity as a wholesaler. According to this, we report that the eligible gross profit is a 7.5%, and the aligned gross profit is a 0.1% in the fiscal year 2024 (vs. 4.5% and 0.002%, respectively, in the financial year 2023).

The gross profit is also called economic sales in this report, because it is a nomenclature that Logista uses for this variable.

Template: Proportion of turnover from products or services associated with Taxonomy-aligned economic activities –

disclosure fiscal year 2024 (Delegated Regulation 2023/2486)

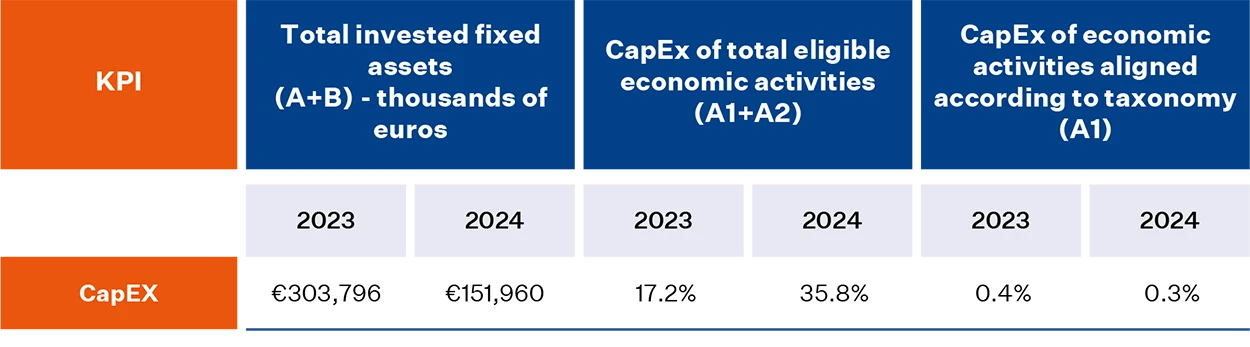

CapEx KPIs

CapEx KPI is defined as the ratio of CapEx associated with eligible and aligned activities (numerator) to total CapEx at group level (denominator). Total CapEx covers asset additions before depreciation, amortization, revaluation and impairment (excluding changes in fair value), including asset additions resulting from business combinations. The types of asset additions to be accounted for, in accordance with the taxonomy legislation, are defined by the following accounting standards:

IAS 16 Property, Plant and Equipment, paragraph 73, letter e), sections i) and iii );

IAS 38 Intangible Assets, paragraph 118(e)(i);

IAS 40 Investment Property, paragraph 76,

IAS 40 Investment Property, paragraph 79(d)(i) and ( ii ) (for the cost model);

IAS 41 Agriculture, paragraph 50, letters b) and e);

FRS 16 Leases, paragraph 53, letter h).

Consequently, both the investments undertaken by Logista directly and the additions of assets that have been a consequence of the incorporation of new companies into the accounting perimeter (particularly, Belgium Parcels Service, BPS), have been compiled by business combination, also identifying, among these asset additions, which were eligible and/or aligned. This compilation of asset additions has been carried out independently, avoiding any double counting in the process. In addition, each investment made by Logista has a unique investment code, which also avoids any type of double counting.

On the other hand, the denominator of this key indicator is directly linked to the consolidated annual accounts for the year ended 30 September 2024 of Logista, and has been obtained as the sum of the costs corresponding to “Additions or Change for the Year” and “Business combinations” associated with the concepts: “Property, plant and equipment” (see the table in note 6.1.), “Rights of use” (see the table in note 6.2.) and “Other intangible assets” (see the table in note 8.). In compliance with the provisions of Delegated Regulation 2021/2178, these calculations do not include the goodwill resulting from the business combination that occurred in the year (the incorporation of BPS), which appears in a separate line.

Template: Proportion of CapEx from products or services associated with Taxonomy-aligned economic activities –

disclosure fiscal year 2024 (Delegated Regulation 2023/2486)

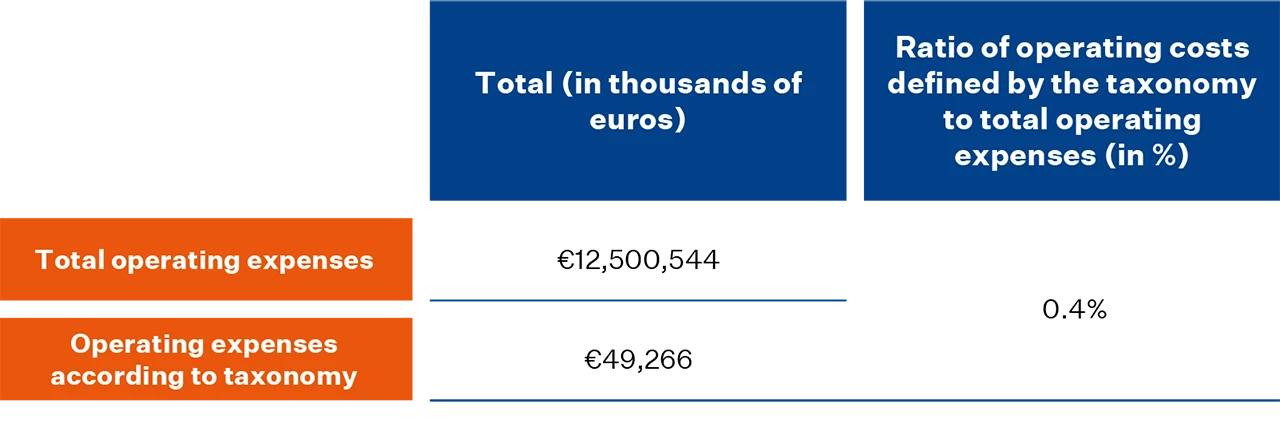

OpEx KPIs

The taxonomy regulation redefines the concept of operating expenditure (OpEx) indicator, for eligibility and alignment, as the quotient between the eligible and aligned taxonomic OpEx according to the taxonomy (numerator) and the total “taxonomic” OpEx (denominator).

According to the applicable legislation (Annex I of Delegated Regulation 2021/2178), the “taxonomic OpEx” is reduced to the accounting of non- capitalized operating expenses, which relate to research and development, building renovation measures, short-term leases, maintenance and repairs, as well as other direct expenses related to the daily maintenance of tangible fixed assets by the company or a third party to whom activities are outsourced and which are necessary to ensure the continued and efficient operation of such assets.

In relation to this KPI, in accordance with the characteristics of Logista’s business model, and based on the provisions of section 1.1.3.2 of Annex I of Delegated Regulation 2021/2178 of July 6, 2021, we report this KPI as immaterial.

To justify the non-materiality of this indicator, we have calculated the quotient between the so-called “taxonomic” OpEx and the total operating expenses of the group. This quotient is much lower than the materiality threshold defined by the Company, equal to 5%. Specifically, only 0.4% of the group’s total operating expenses correspond to operating expenses defined according to the taxonomy (“Taxonomic OpEx”), as shown in the following table.

The result obtained is consistent with the type of operating expenses incurred by the group and with the relevance of procurement expenses compared to other operating expenses.

Consequently, and considering the provisions of section 1.1.3.2 of Annex I of the Delegated Regulation of July 6, 2021, we report the numerator of the OpEx key indicator (OpEx KPI) equal to zero.

Template: Proportion of OpEx from products or services associated with Taxonomy-aligned economic

activities – disclosure covering fiscal year 2024 (Delegated Regulation 2023/2486)

Row

Nuclear energy related activities

YES/NO

1

The undertaking carries out, funds or has exposures to research, development, demonstration and deployment of innovative electricity generation facilities that produce energy from nuclear processes with minimal waste from the fuel cycle.

NO

2

The undertaking carries out, funds or has exposures to construction and safe operation of new nuclear installations to produce electricity or process heat, including for the purposes of district heating or industrial processes such as hydrogen production, as well as their safety upgrades, using best available technologies.

NO

3

The undertaking carries out, funds or has exposures to safe operation of existing nuclear installations that produce electricity or process heat, including for the purposes of district heating or industrial processes such as hydrogen production from nuclear energy, as well as their safety upgrades.

NO

Row

Fossil gas related activities

YES/NO

4

The undertaking carries out, funds or has exposures to construction or operation of electricity generation facilities that produce electricity using fossil gaseous fuels.

NO

5

The undertaking carries out, funds or has exposures to construction, refurbishment, and operation of combined heat/cool and power generation facilities using fossil gaseous fuels.

NO

6

The undertaking carries out, funds or has exposures to construction, refurbishment and operation of heat generation facilities that produce heat/cool using fossil gaseous fuels.

NO

Row

1

2

3

Nuclear energy related activities

The undertaking carries out, funds or has exposures to research, development, demonstration and deployment of innovative electricity generation facilities that produce energy from nuclear processes with minimal waste from the fuel cycle.

The undertaking carries out, funds or has exposures to construction and safe operation of new nuclear installations to produce electricity or process heat, including for the purposes of district heating or industrial processes such as hydrogen production, as well as their safety upgrades, using best available technologies.

The undertaking carries out, funds or has exposures to safe operation of existing nuclear installations that produce electricity or process heat, including for the purposes of district heating or industrial processes such as hydrogen production from nuclear energy, as well as their safety upgrades.

YES/NO

NO

NO

NO

Row

4

5

6

Fossil gas related activities

The undertaking carries out, funds or has exposures to construction or operation of electricity generation facilities that produce electricity using fossil gaseous fuels.

The undertaking carries out, funds or has exposures to construction, refurbishment, and operation of combined heat/cool and power generation facilities using fossil gaseous fuels.

The undertaking carries out, funds or has exposures to construction, refurbishment and operation of heat generation facilities that produce heat/cool using fossil gaseous fuels.

YES/NO

NO

NO

NO

Appendix V

Contents required under act 11/2018 and GRI indicators and by the EU regulation (2020/852) – Taxonomy

Contents required under act 11/2018 and GRI indicators

Contents

Reference

Reporting framework

Business model

Business environment and business model

7-37

GRI 2-1, 2-6

Materiality analysis

110-113

GRI 3-1

Organisation and structure

14-15, 114-115

GRI 2-1, 2-6a, 2-6c

Markets in which the company operates

20-21

GRI 2-6a, 2-6c

Objectives and strategies

17-19

GRI 2-1, 2-6a, 2-6c

Factors and trends affecting performance

59-61

GRI 2-1, 2-6

Policies

These are set out in detail according to subject area in each of the respective sections of this report

GRI 3-3

Risks

These are set out in detail according to subject area in each of the respective sections of the report; in particular in Corporate Governance / Risk and Opportunity Management

Internal framework: qualitative description of the main risks

Environmental matters

Global

Effects of the company’s operations on the environment, and on people’s health and safety

90-106

Internal framework: qualitative description of the principle effects

Environmental assessment or certification procedures

92, 101-106

Internal framework: qualitative description of assessments and certifications

Principle of precaution, number of provisions and guarantees for environmental risks

97

GRI 3-3

Resources dedicated to environmental risk prevention

97

Internal framework: qualitative description of dedicated resources

Pollution

Measures associated with carbon emissions

101-102

Internal framework: qualitative description of key measures and action taken

Measures associated with light, noise and other types of pollution

103

Internal framework: qualitative description of key measures and action taken

Circular economy and waste prevention and management

Initiatives aimed at promoting circular economy

105-106

GRI 306-2

Measures associated with waste management

106

GRI 306-2

Actions to combat food waste

No details, bearing in mind the company’s business sector

n.a.

Sustainable use of resources

Water: consumption and supply

105

GRI 303-5

Raw materials: consumption and measures

105

GRI 301-1

Energy: consumption, measures and use of renewables

104-105

GRI 302-1

Environmental issues

Climate change

Greenhouse gas emissions

100

Internal framework

Measures to adapt to climate change

10093-96

Internal framework: qualitative description of measures

Emission reduction targets

96, 101-102

Internal framework: Qualitative description of targets

Biodiversity

Conservation measures

104

Internal framework: qualitative description of measures

Impacts on protected areas

104

GRI 304-2

Social and staff-related matters

Employment

Total number of employees and distribution by gender, age, nationality and professional category

87

GRI 2-7

Total number and distribution of work contract types

87

GRI 2-7

Annual average of permanent, temporary and part-time employees by gender, age and professional category

87

GRI 2-7

Number of dismissals by gender, age and professional category

89

Internal framework: total number of dismissals during the financial year broken down by gender, age and professional category

Average pay and change in average pay by gender, age and professional category, or equivalent

76

Internal framework: average remuneration (including fixed and variable remuneration)

Gender pay gap, remuneration for similar jobs or the company average

75-76

Internal framework: (1-(average male

remuneration – average female remuneration) /

average male remuneration)

Average remuneration of board members and directors

76

Internal framework: average remuneration including fixed and variable remuneration

Policies for disconnecting from work

77

Internal framework: qualitative description of policies in force

Employees with disabilities

73

Internal framework: number of employees with disabilities who have been hired during the fiscal year

Social and personnel issues

Organization of working time

Organization of work

77

Internal framework: qualitative description of organization of working time

Number of hours of absenteeism

80

Internal framework: number of hours of absenteeism

Measures for work-life integration

77

Internal framework: qualitative description of measures

Health and safety

Health and safety conditions in the workplace

78-79

GRI 403-1, 403-2, 403-3, 403-5, 403-6

Workplace accidents, particularly their frequency and severity

79

Internal framework: Frequency index: number of work-related accidents resulting in sick leave for every 1,000,000 hours worked. Severity index: number of working days lost due to work-related accidents resulting in sick leave for every 1.000 hours worked. Lost time accident rate: number of work-related accidents resulting in sick leave for every 200,000 hours worked

Professional illnesses, separated by gender

79

Internal framework

Social relationships

Facilitating social dialogue

80

Internal framework: qualitative description of the ways in which social dialogue is facilitated

Percentage of employees covered by collective bargaining agreements by country

80

Internal framework

Assessment of collective bargaining agreements on health and safety in the workplace

80

GRI 3-3

Training

Policies implemented in training

74

Internal framework: qualitative description of measures

Total hours of training by professional category

74

Internal framework: qualitative description of measures

Social and personnel issues

Equality

Universal access for people with disabilities

73

Internal framework: qualitative description of diversity management

Measures adopted to promote equality, plans for equality and policy against discrimination and diversity management

71-73

Internal framework: qualitative description of measures

Equality plans and measures adopted to promote employment, protocols to prevent sexual and gender-based harassment

71-73

Internal framework: qualitative description of measures

Policy against any form of discrimination and, where applicable, for diversity management

71-73

Internal framework: qualitative description of diversity management

Human Rights

Due diligence procedures in human rights matters and where applicable, in relation to their mitigation, management and remedy

44, 45

GRI 2-26

Complaints relating to human rights violations

48-49

Internal framework

Promoting and compliance of ILO covenants relating to freedom of association and collective bargaining

50, 80

GRI 2-23

Elimination of employment discrimination, forced and child labour

49

GRI 2-23

Corruption and bribery

Measures adopted to prevent corruption and bribery

44-49

GRI 2-26

Measures to combat money laundering

44-49

GRI 2-26

Contributions to foundations and nonprofit organizations

86

Internal framework: amount of contributions in euros

Society

Company commitments to sustainable development

Impact of the company’s activity on local employment and development, local populations and populations in Spain

682-86

Internal framework: qualitative description of impact

Dialogue with the local community

113

Internal framework: qualitative description of dialogue

Partnership and sponsorship initiatives

86

GRI 2-28

Subcontracting and suppliers

Inclusion of social, gender equality and environmental matters in the procurement policy

63

GRI 2-6, 308-1

Consideration of social and environmental responsibility in relations with suppliers and subcontractors

63

GRI 2-6, 308-1

Monitoring and auditing systems and their results

63

Internal framework: qualitative description of the reviews forming part of the control systems in operation in each business

Consumers

Consumer health and safety measures

22-27

Internal framework: qualitative description of measures

Complaints and claims systems and resolution process

25

GRI 2-26

Fiscal reporting

Profits by country

53

Internal framework: pre-tax profit/ (loss) by country

Income tax paid

53

Internal framework: corporation tax paid by country

Public subsidies received

56

Internal framework: amount received in government grants

Table of contents required by EU Regulation (2020/852) – Taxonomy

Regulation Requirements

Reference

Reporting framework

Taxonomy EU

Eligible and non-eligible economic activities according to EU taxonomy

Aligned and non-aligned economic activities according to taxonomy

Article 8 of Regulation EU (2020/852) of the Taxonomy and the Delegated Regulations (Delegated Act EU 2021/2139 – climate, Delegated Act EU 2021/2178 – disclosure, Delegated Act EU 2023/2485 – new climate activities and Delegated Act EU 2023/2486 – four remaining objectives and disclosure), complementing with own methodology explained in Annex IV of Taxonomy.

Regulation Requirements

Taxonomy EU

Eligible and non-eligible economic activities according to EU taxonomy

Aligned and non-aligned economic activities according to taxonomy

Referencia

Reporting framework

Taxonomy EU

Article 8 of Regulation EU (2020/852) of the Taxonomy and the Delegated Regulations (Delegated Act EU 2021/2139 – climate, Delegated Act EU 2021/2178 – disclosure, Delegated Act EU 2023/2485 – new climate activities and Delegated Act EU 2023/2486 – four remaining objectives and disclosure), complementing with own methodology explained in Annex IV of Taxonomy.

Appendix VI

Verification report

Independent Limited Assurance Report on the Consolidated Non-Financial Statement for the year ended September 30, 2024.

LOGISTA INTEGRAL, S.A. (previously referred to as COMPAÑÍA DE DISTRIBUCIÓN INTEGRAL LOGISTA HOLDINGS, S.A.) AND SUBSIDIARIES.